There is no need to stress! e-PayDay Go Award-centric payroll software ensures you effortlessly comply with the Fair Work Voluntary Small Business Wage Compliance Code.

1300 EPAYDAY (1300 372 932)

Easily create Wages and Salary pay slips complying with your Fair Work and Australian Taxation Office (ATO) obligations.

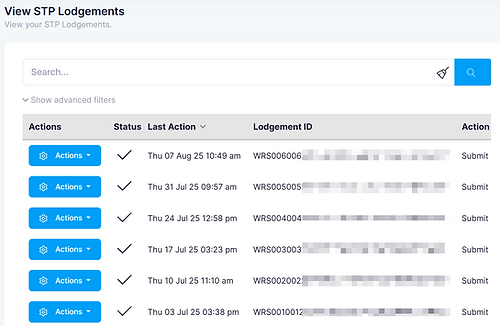

Do I need to use Single Touch Payroll software (STP) to generate pay slips?

Processing an employee's pay involves complex calculations that can be intricate and time-consuming. Payroll software is essential to perform these computations and ensure that all the information is reported correctly. Using technology streamlines the payroll process, assists in minimising errors and facilitates accurate remuneration for each employee. After the pay has been processed, the results must be lodged with the Australian Taxation Office (ATO), and the only way to meet the reporting requirements is by using software.

Multiple free Fair Work compliant Pay Slip templates are included.

e-PayDay FREEPAY® provides built-in pay slip templates that can be emailed or exported in numerous formats.

Pay slip features:

-

Pay Slips are generated and easily emailed as a PDF file to your employees via e-PayDay FREEPAY®.

-

Multiple Fair Work compliant Pay Advice Slip Templates are available.

-

Pay slips are automatically generated and securely accessed using our ClockMeIn® Payrollee Self Service STP Mobile App.

What information must be included on a pay slip?

Pay slips must include specific information to promote transparency and compliance, as outlined by the Fair Work Act 2009 and the Fair Work Regulations 2009 s3.46.

e-PayDay FREEPAY® meets all the Fair Work requirements but offers much more:

Options can be easily configured:

-

Selection of leave types displayed on the pay slip and the duration after which they appear.

-

The ability to display individual dates for each transaction line.

-

Comments can be added to each transaction line.

-

Loadings can be easily separated.

-

Global or individual comments can be shown on the pay slip.

Do I have to show loadings separately on the pay slip?

Any loadings (including casual loading), allowances, bonuses, incentive-based payments, penalty rates or other paid entitlements should be separated from an employee’s ordinary hourly rate, refer to Casual employees, and the crucial information required on pay slips.

Do I have to show Leave Balances on pay slips?

While it's best practice to show employees' leave balances on their pay slip, it’s not required (unless stated in the Award).

Leave that can be shown on a pay slip include:

-

Annual leave

-

Sick and carer’s leave

-

Long Service Leave.

If the pay slip does not include this information, employers must inform employees of their leave balances if requested.

Do I show Paid Family and Domestic Violence Leave (PFDVL) on pay slips?

Specific rules govern how information about paid family and domestic violence leave is reported on pay slips and what information should not be included. This reduces the risk to an employee’s safety when accessing paid family and domestic violence leave.

Pay slips must not mention paid family and domestic violence leave, when including any leave taken and leave balances.

An amount paid to an employee for taking PFDVL has to be recorded on a pay slip as:

-

ordinary hours of work, or

-

another kind of payment for performing work, such as an allowance, bonus or overtime payment.

However, if an employee requests it, their employer can record time taken as PFDVL as another type of leave on their pay slip (for example, Annual Leave).

If an employee has taken a period of paid family and domestic violence leave, it is best practice to record this on their pay slip in a way that makes the pay slip look as close as possible to how it would have looked if the employee had not taken the PFDVL leave.

When should pay slips be provided to my employees, and how should I give them?

It's essential to ensure that employees receive their pay slips within one working day of pay day, even if they’re away on leave. Pay slips can be provided as hard copies (printed) or electronically (sent by email or available through an Employee Self Service app or website portal). If provided electronically, they must contain the same information as paper copies.

Pay Slips can be easily emailed and are also available in the free Single Touch Payroll (STP) employee self-service mobile app.

Meet your Fair Work employee pay slip and record-keeping obligations while providing your employees with financial peace of mind every payday!

Easily view pay slips anytime using the app, keeping financial information conveniently at your fingertips and always up-to-date when using our ClockMeIn® Employee Self Service STP mobile app.

Powerful pay slip benefits:

-

Easy management of pay slips, providing simple access to the complete employment history.

-

ClockMeIn® offers a user-friendly pay slip summary in plain language, making it easy to grasp the essential details of the earnings quickly.

Get started now with the best free pay slip generator tool in three simple steps, and join thousands of other small business owners. 100% free for the first three employees!

Step 1

Fill out a simple form to sign up to begin your payroll journey, and keep your credit or debit card in your wallet.

Step 2

You will receive an email when your account is activated after verification, then you can sign in and start immediately.

Step 3

Three simple steps to begin, then add your employees, and you'll be ready to process your first pay run.

- 01

- 02

- 03

- 04

- 05

- 06

- 07

- 08

- 09

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

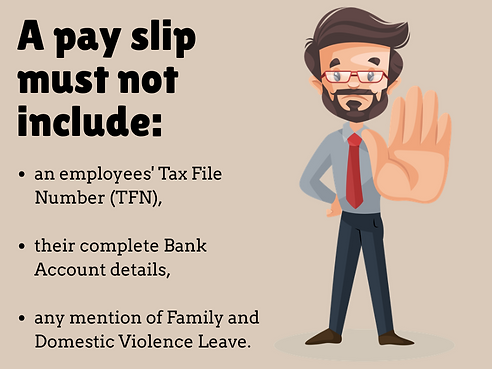

What am I required not to show on the pay slip?

Do not include:

-

Employees' Tax File Number (TFN),

-

Complete Bank Account details,

-

Family and Domestic Violence Leave balances,

If an employee takes Family and Domestic Violence leave, it must be recorded on the pay slip without the description "Family and Domestic Violence Leave".

Do I have to provide the Award and Classification or the Registered/ Enterprise Agreement name on pay slips?

Although the requirement is not currently legislated to display the Award and Classification or the Registered Agreement name on the pay slip, it is considered best practice to include this information. When using e-PayDay FREEPAY®, every Award and Classification is included, so you can effortlessly meet the Fair Work Voluntary Small Business Wage Compliance Code.

What happens if I don't provide pay slips or if they contain incorrect information?

Fair Work Inspectors can issue an employer a fine, known as an infringement notice, if:

-

Incorrect information is provided on a pay slip.

-

Pay slips are not provided within one working day of pay day or are never supplied.

It is also unlawful for employers to give pay slips that they know are false or misleading.

As an employee, what can I do if I am not receiving my pay slips from my employer?

If, as an employee, you don’t receive a pay slip, Fair Work encourage you to talk to your employer. Find step-by-step advice on starting this process when I'm not getting pay slips.