There is no need to stress! e-PayDay Go Award-centric payroll software ensures you effortlessly comply with the Fair Work Voluntary Small Business Wage Compliance Code.

1300 EPAYDAY (1300 372 932)

Easily create Wages and Salary pay slips complying with your Fair Work and Australian Taxation Office (ATO) obligations.

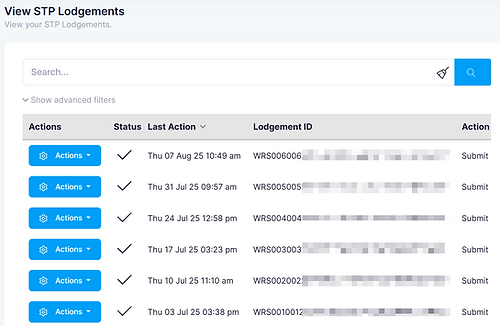

Do I need to use Single Touch Payroll software (STP) to generate pay slips?

Processing an employee's pay involves complex calculations that can be intricate and time-consuming. Payroll software is essential to perform these computations and ensure that all the information is reported correctly. Using technology streamlines the payroll process, assists in minimising errors and facilitates accurate remuneration for each employee. After the pay has been processed, the results must be lodged with the Australian Taxation Office (ATO), and the only way to meet the reporting requirements is by using software.

Multiple free Fair Work compliant Pay Slip templates are included.

e-PayDay FREEPAY® provides built-in pay slip templates that can be emailed or exported in numerous formats.

Pay slip features:

-

Pay Slips are generated and easily emailed as a PDF file to your employees via e-PayDay FREEPAY®.

-

Multiple Fair Work compliant Pay Advice Slip Templates are available.

-

Pay slips are automatically generated and securely accessed using our ClockMeIn® Payrollee Self Service STP Mobile App.

What information must be included on a pay slip?

Pay slips must include specific information to promote transparency and compliance, as outlined by the Fair Work Act 2009 and the Fair Work Regulations 2009 s3.46.

e-PayDay FREEPAY® meets all the Fair Work requirements but offers much more:

Options can be easily configured:

-

Selection of leave types displayed on the pay slip and the duration after which they appear.

-

The ability to display individual dates for each transaction line.

-

Comments can be added to each transaction line.

-

Loadings can be easily separated.

-

Global or individual comments can be shown on the pay slip.

Do I have to show loadings separately on the pay slip?

Any loadings (including casual loading), allowances, bonuses, incentive-based payments, penalty rates or other paid entitlements should be separated from an employee’s ordinary hourly rate, refer to Casual employees, and the crucial information required on pay slips.

Do I have to show Leave Balances on pay slips?

While it's best practice to show employees' leave balances on their pay slip, it’s not required (unless stated in the Award).

Leave that can be shown on a pay slip include:

-

Annual leave

-

Sick and carer’s leave

-

Long Service Leave.

If the pay slip does not include this information, employers must inform employees of their leave balances if requested.

Do I show Paid Family and Domestic Violence Leave (PFDVL) on pay slips?

Specific rules govern how information about paid family and domestic violence leave is reported on pay slips and what information should not be included. This reduces the risk to an employee’s safety when accessing paid family and domestic violence leave.

Pay slips must not mention paid family and domestic violence leave, when including any leave taken and leave balances.

An amount paid to an employee for taking PFDVL has to be recorded on a pay slip as:

-

ordinary hours of work, or

-

another kind of payment for performing work, such as an allowance, bonus or overtime payment.

However, if an employee requests it, their employer can record time taken as PFDVL as another type of leave on their pay slip (for example, Annual Leave).

If an employee has taken a period of paid family and domestic violence leave, it is best practice to record this on their pay slip in a way that makes the pay slip look as close as possible to how it would have looked if the employee had not taken the PFDVL leave.

When should pay slips be provided to my employees, and how should I give them?

It's essential to ensure that employees receive their pay slips within one working day of pay day, even if they’re away on leave. Pay slips can be provided as hard copies (printed) or electronically (sent by email or available through an Employee Self Service app or website portal). If provided electronically, they must contain the same information as paper copies.

Pay Slips can be easily emailed and are also available in the free Single Touch Payroll (STP) employee self-service mobile app.

Meet your Fair Work employee pay slip and record-keeping obligations while providing your employees with financial peace of mind every payday!

Easily view pay slips anytime using the app, keeping financial information conveniently at your fingertips and always up-to-date when using our ClockMeIn® Employee Self Service STP mobile app.

Powerful pay slip benefits:

-

Easy management of pay slips, providing simple access to the complete employment history.

-

ClockMeIn® offers a user-friendly pay slip summary in plain language, making it easy to grasp the essential details of the earnings quickly.

Get started now with the best free pay slip generator tool in three simple steps, and join thousands of other small business owners. 100% free for the first three employees!

Step 1

Fill out a simple form to sign up to begin your payroll journey, and keep your credit or debit card in your wallet.

Step 2

You will receive an email when your account is activated after verification, then you can sign in and start immediately.

Step 3

Three simple steps to begin, then add your employees, and you'll be ready to process your first pay run.

-

Is e-PayDay FREEPAY® fully functional?Yes, e-PayDay FREEPAY® is only limited by the number of employees you can enter (or terminate) before having to move to a paid plan.

-

Do you offer a free pay slip generator?With our free pay slip generator, pay slips can be emailed or accessed from the free employee self service mobile app. You can also download a Pay Slip PDF template.

-

What is the difference between e-PayDay FREEPAY® and e-PayDay Go®?There is very little difference between e-PayDay FREEPAY® and e-PayDay Go®. Both products share the same foundation and unified codebase. e-PayDay FREEPAY® is marketed to those that are have a micro or small busines and are looking to start with a free or low cost Single Touch Payroll product.

-

How many employees can I process without paying for a plan?The first three employees won't cost you anything, 100% free, including Single Touch Payroll (Phase 2) and Payday Super reporting! When you want to add more employees, it's as simple as choosing the plan that best suits your needs. We have always provided tiered plans, allowing you to stay in total control of your payroll costs and making management easy. We are aware of a few payroll products that offer the ability to add an unlimited number of employees free of charge. However, providing a comprehensive payroll offering costs a substantial amount of money to develop and maintain. We have asked our team to work for free, but they selfishly expect payment for the outstanding efforts they perform. Since 1987, we have continued to build comprehensive payroll solutions and do not want to provide you with a product that offers minimal features and functionality. After all, a standard is required to meet Fair Work and Australian Taxation Office compliance requirements. If specific functionality is missing, you must continually request features because you cannot meet your legal obligations.

-

What's the catch, why is e-PayDay FREEPAY® free for three employees?There isn't one! The first three (3) employees are always 100% free. You can use e-PayDay FREEPAY® and pay nothing, zero, zilch, nada, nix, naught. We believe every employer should have access to comprehensive cloud Single Touch Payroll software, so we made it free to pay your first three (3) employees. Customers who have chosen a paid Subscription Plan cannot downgrade to the FREEPAY Plan. e-PayDay FREEPAY® allows a limited number of employee terminations. When you choose a paid plan, the number of terminated employees is unlimited. Since 1987, we have supported Australian Small Businesses by providing Australia's free payroll software; it's in our DNA. Helping you grow your Business helps us grow ours!

-

Is e-PayDay FREEPAY® complicated to set up?While the process may feel overwhelming and daunting to some, many users find it easy to set up e-PayDay FREEPAY®, but others may require some assistance. Payroll involves complex requirements, so it's essential that we meet the standards set by the Australian Taxation Office (ATO) and the 122 Fair Work Modern Awards. We also provide the ability to set up Agreements. We have real people available to help you set up. In many cases, this process takes less than ten minutes. The time required depends entirely on the complexity of your business needs and the Fair Work Awards applicable. If your needs are straightforward, once we help you with your setup, you'll discover that e-PayDay FREEPAY® is user-friendly, as your payroll processes will become repetitive and easy.

-

Is support provided?Absolutely! FREEPAY includes 30 days of complimentary setup assistance and support. Rest assured, all our paid plans come with ongoing support and you can always count on speaking with a real person on the phone.

-

Does e-PayDay Go FREEPAY® include Payday Super?The recent announcement of Payday Super by Treasury (18/09/2024) has revealed that the Small Business Superannuation Clearing House (SBSCH) will be discontinued. e-PayDay FREEPAY® supports Payday Super, including the Single Touch Payroll reporting of both the OTE and SG amounts. These amounts have been STP reported by e-PayDay payroll products since 2017. Starting in December 2025, you can effortlessly pay your SG with e-PayDay FREEPAY® while processing your pay run or within seven days. It's a seamless and convenient solution!

-

What happens after the first 12 months of using e-PayDay FREEPAY®?e-PayDay FREEPAY® has been free since 1987 and will continue to be provided at no cost.

-

Do I have to pay for terminated employees?No, terminated employees are omitted when calculating the cost of your subscription plan. Paid plans allow for an unlimited number of terminated employees. e-PayDay Go FREEPAY® allows up to three (3) employee terminations.

-

What does it cost to email Pay Slips?Emailing Pay Slips is provided at no additional cost.

-

Do I have to pay extra for Single Touch Payroll Phase 2 and Payday Super reporting?Your subscription includes Single Touch Payroll and Payday Super reporting to the Australian Taxation Office, and the number of reports that can be sent to the ATO is unlimited.

-

Is it possible to change my plan when the number of my employees varies?You have the flexibility to adjust your plans whenever your employee needs change. All you need to do is choose the plan you want to switch to and select Change. It's a simple process that can be done at any time.

-

If I have multiple companies, will I need to purchase a separate plan for each one?To access multiple ABN/Branches, you need a separate plan for each one. However, you can use the same email address for all of them and we offer a discount for additional subscriptions.

-

Can I use e-PayDay FREEPAY® on any device, including Apple Mac and iPad?e-PayDay FREEPAY® is compatible with any device that has an internet browser, including desktop computers, laptops, tablets, and smartphones.

-

Can I use e-PayDay FREEPAY® on my Mobile Phone?Yes, but we don't recommend using e-PayDay FREEPAY® on a mobile phone because the screen is usually small, making it impractical to fully utilise the advanced features and functionality.

-

Can I pay my subscription yearly?We only offer yearly subscriptions in limited situations, which require payment by Invoice. If you decide to cancel, you will not receive a refund for the unused portion. Opting to pay monthly allows you to switch between plans at any time during your subscription period. To discuss a yearly subscription, please contact our Sales and Administration team.

-

Can I pause my subscription?You can select an Archive plan for a nominal monthly cost. You have full access to your data, with the only restriction being the ability to process pay runs. An Archive plan also allows you to comply with the Fair Work Act 2009 record-keeping obligations when you're not using your regular plan.

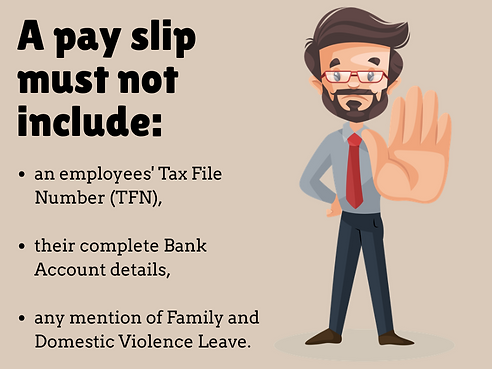

What am I required not to show on the pay slip?

Do not include:

-

Employees' Tax File Number (TFN),

-

Complete Bank Account details,

-

Family and Domestic Violence Leave balances,

If an employee takes Family and Domestic Violence leave, it must be recorded on the pay slip without the description "Family and Domestic Violence Leave".

Do I have to provide the Award and Classification or the Registered/ Enterprise Agreement name on pay slips?

Although the requirement is not currently legislated to display the Award and Classification or the Registered Agreement name on the pay slip, it is considered best practice to include this information. When using e-PayDay FREEPAY®, every Award and Classification is included, so you can effortlessly meet the Fair Work Voluntary Small Business Wage Compliance Code.

What happens if I don't provide pay slips or if they contain incorrect information?

Fair Work Inspectors can issue an employer a fine, known as an infringement notice, if:

-

Incorrect information is provided on a pay slip.

-

Pay slips are not provided within one working day of pay day or are never supplied.

It is also unlawful for employers to give pay slips that they know are false or misleading.

As an employee, what can I do if I am not receiving my pay slips from my employer?

If, as an employee, you don’t receive a pay slip, Fair Work encourage you to talk to your employer. Find step-by-step advice on starting this process when I'm not getting pay slips.