There is no need to stress! e-PayDay Go Award-centric payroll software ensures you effortlessly comply with the ATO Payday Super requirements and the Fair Work Voluntary Small Business Wage Compliance Code.

1300 EPAYDAY (1300 372 932)

e-PayDay FREEPAY®

The Perpetual Free Payroll Tier for Australian Micro-Businesses

While many providers offer limited "free trials," e-PayDay FREEPAY® is a genuine, long-term solution for Australia's smallest employers. Designed specifically for businesses with 3 or fewer employees, it provides full STP Phase 2 compliance without the burden of a monthly subscription overhead.

-

100% Australian Made Owned: Developed locally since 1987 to meet rigorous ATO and Fair Work standards.

-

Real-Time Fair Work Compliance: Access all 122 Modern Awards and classifications directly within the software. Our "Award-centric" engine automatically updates pay rates, ensuring you stay compliant with the Fair Work Ombudsman and the Voluntary Small Business Wage Compliance Code.

-

Automated Compliance: From Payday Super mandates to the latest Tax Scales, we handle the technical updates so you don't have to.

-

Industry Agnostic: Whether you are in Retail, Hospitality, Trades, or Professional Services, our intuitive interface adapts to your specific workflow needs and industry requirements.

Ready to Scale Your Business?

As your team grows, your payroll shouldn't break. e-PayDay FREEPAY® offers a seamless, data-migration-free upgrade path to e-PayDay Go®. Unlock advanced reporting, larger employee capacities, and enhanced functionality the moment your business needs them—all within the same trusted ecosystem.

ATO Small Business Super Clearing House Alternative

The ATO has confirmed the Small Business Superannuation Clearing House (SBSCH) will close permanently on 1 July 2026. Don't wait for the deadline to scramble—discover why e-PayDay FREEPAY® is the top-rated free alternative and get your 2026 migration checklist today.

Payroll that Integrates with Government Services

e-PayDay FREEPAY® is designed for small businesses by integrating directly with government systems to streamline your compliance obligations in real time. We provide seamless access to essential services from the Australian Taxation Office (ATO), the Fair Work Commission, the Fair Work Ombudsman, and Services Australia. By automating these connections, we help you maintain accuracy and meet your regulatory requirements with ease.

Easy Payroll Software with Comprehensive Features

Powerful functionality designed to make your pay day easier.

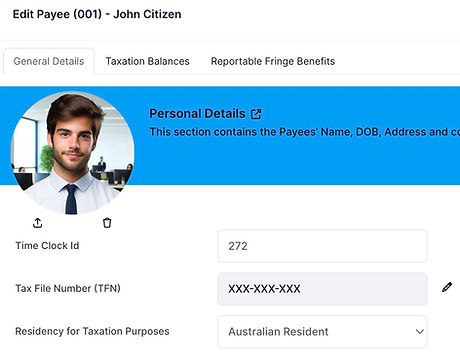

Maintain Employees

Easily manage personal and employment information for Weekly, Fortnightly, and Monthly employees. Additionally, pay Full-Time, Part-Time, Casual, Closely Held and Salaried employees. Pay based on their location or department with ease.

Easily Track Leave

Automatically tracks and accrues your Sick, Annual Leave, Long Service Leave, PFDVL, RDOs, and TOIL. You can choose from various accrual methods that suit your needs. In addition, we provide detailed reporting features to help you stay on top of leave management.

Fair Work Awards

All of the 122 Modern Awards and Employment Agreements can be easily accessed to suit your exact requirements. Includes comprehensive management of Fair Work Awards and Agreements helping you to easily remain compliant.

Payday Super

Managing your Superannuation Funds and payments has never been easier. With the Payday Super feature, you can easily transfer payments electronically. Everything you need for your Super management is located in one convenient place.

Powerful Pay Runs

We offer flexible options for pay runs, allowing you to choose from weekly, fortnightly, monthly, or any other period that suits your needs. Our electronic transfer system to any ABA member financial institution makes payments seamless and hassle-free.

Flexible Payee and Employment Management

Effortlessly manage your workforce regardless of how their income is taxed. e-PayDay FREEPAY® utilises the Payee Master File and intelligent automation to handle diverse STP employment classifications, ensuring accuracy, consistency, and full STP Phase 2 compliance across your entire team.

-

Diverse Employment Types: Built-in support for Regular employees, Closely Held Payees (CHP), Seniors and Pensioners (SAPTO), Working Holiday Makers (WHM), Foreign Residents, and Seasonal Workers.

-

Specialised Industry Support: Includes dedicated handling for Horticulturists, Shearers, and ATO-defined Death Beneficiaries, with future support for Voluntary Agreements and Actors.

-

Flexible Employment Basis: Seamlessly manage Full-Time, Part-Time, and Casual staff within a single, streamlined interface.

-

Automated Compliance: Intelligent tax treatment selection based on payee status ensures your business stays compliant with ATO requirements at all times.

Closely Held Payees (CHP) and Director Reporting

Pay your family members and business associates with confidence while meeting all Australian Taxation Office (ATO) requirements. e-PayDay FREEPAY® simplifies reporting for individuals with a direct relationship to the payer, ensuring your family business or corporate structure remains fully compliant.

-

Broad Payee Support: Easily manage and report family members, company directors, shareholders, and trust beneficiaries.

-

Flexible Reporting Options: Meet your obligations with support for various reporting frequencies, allowing you to report for any required period, including Quarterly and Yearly.

-

Family Business Ready: Designed specifically to handle the nuances of "Closely Held" arrangements within the STP Phase 2 framework.

-

Seamless ATO Integration: Direct reporting from the Payee Master File ensures that director fees and family wages are accurately recorded and declared.

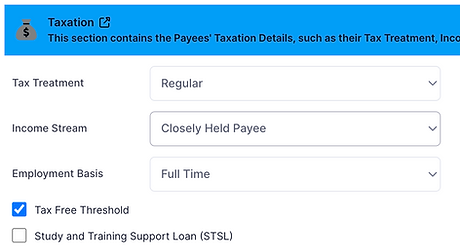

Automated ATO Tax Calculations

Utilise official Australian Taxation Office (ATO) formulas to perform payroll calculations automatically. By factoring in specific tax treatments and pay types, e-PayDay FREEPAY® ensures streamlined, accurate PAYG tax calculations that save time and eliminate manual errors.

-

Diverse Tax Treatments: Supports Regular, Seniors and Pensioners (SAPTO), Working Holiday Makers, and Foreign Residents.

-

Total Control: Manually adjust PAYG tax, Qualifying Earnings (QE/SG), and RESC calculations whenever required.

-

X-Ray View: Gain detailed insights into exactly how different components are calculated for total transparency and audit purposes.

-

Automatic Compliance: ATO Tax Tables are updated automatically, ensuring you always stay aligned with current legislation.

Fair Work-Compliant Pay Slip Generator

e-PayDay FREEPAY® includes a powerful, integrated pay slip generator. Effortlessly create professional, Fair Work legally compliant pay advice using built-in templates designed specifically for the Australian regulatory environment.

-

Free & Professional: Includes multiple professional templates provided at no additional cost.

-

Automated Workflow: Payslips are generated automatically as part of your standard payroll process.

-

Fair Work Compliance: Access templates that meet all Fair Work Ombudsman requirements to protect your business.

-

Secure Distribution: Email payslips directly as secure PDFs or provide access via the ClockMeIn® Employee Self Service (ESS) mobile app.

Simplified Single Touch Payroll (STP) Reporting

Say goodbye to complex reporting processes. e-PayDay FREEPAY® provides an intuitive Single Touch Payroll feature that allows you to effortlessly manage your submissions and stay compliant with the latest ATO regulations at no extra cost.

-

ATO Registered Solution: Report with confidence using a software product fully compliant with the latest Single Touch Payroll (STP) Phase 2 standards.

-

Flexible Event Reporting: Maintain total control over your data by lodging Submit, Update and Final events whenever required to ensure records remain accurate.

-

EOFY Made Easy: Streamline your End of Financial Year finalisation declarations, making it simple to get your employees' income statements "Tax Ready."

-

Zero Cost Compliance: Gain full access to these essential STP reporting features as a standard, built-in part of the e-PayDay FREEPAY® experience.

Superannuation Guarantee (SG) Reporting and Payday Super Compliance

Streamline your superannuation obligations with a fast, accurate, and fully compliant reporting experience. e-PayDay FREEPAY® removes the complexity of managing Super Guarantee (SG) and Payday Super requirements with our Single Touch ePayDay Super® built-in functionality, ensuring your employees' retirement savings are handled with precision.

-

Integrated Clearing House Support: We have partnered with SuperChoice, Australia’s premier clearing house service, to provide instant reporting and payments at no extra cost.

-

Payday Super Ready: Stay ahead of government requirements with a system built to handle Payday Superannuation reporting automatically.

-

The SBSCH Alternative: Eliminate reliance on the Small Business Superannuation Clearing House (SBSCH) ahead of its closure on 1 July 2026.

-

Flexible File Export: Easily create a SuperStream Alternative File Format (SAFF) or a Banking File (.aba) for efficient processing with other Clearing House Solutions.

Ideal for Developers creating Payroll Solutions

Our open API (Application Programming Interface) allows anyone to develop an integration with e-PayDay®. Ideal for other software products, custom software or anything else.

Transparent, Fixed-Tier Pricing

Straightforward pricing for teams with more than three employees.

We offer simple monthly pricing for businesses with more than three employees and contractors. Our fixed-tier plans are easy to understand, providing the flexibility you need with no hidden extras. Whether you are scaling up or managing a steady team, our pricing remains predictable and transparent.

No Activation Fees

No Monthly Service Fee

No Cost Per Pay Period

No Minimum Term

All fees and charges are included in your Monthly Subscription.

Real stories. Zero incentives

We don’t pay for testimonials or third-party reviews, so you can trust that every comment is genuine and unbiased. Discover what our customers really think, unfiltered and unbought.

Begin today with 3 easy steps and complete your first pay run and STP report in just 15 minutes.

Experience a seamless start with our comprehensive 30-day onboarding assistance, available from the moment you submit your initial support request. We're here to ensure your success every step of the way!

Step 1

Fill out a simple form to sign up to begin your payroll journey, and keep your credit or debit card in your wallet.

Step 2

You will receive an email when your account is activated after verification, then you can sign in and start immediately.

Step 3

3 simple steps to begin, then add your employees, and you're ready to process your first pay run in just 15 minutes.

Your Payroll Security is Our Priority

We believe your payroll data belongs in your hands—not someone else's. e-PayDay FREEPAY® Single Touch Payroll software is designed to address the unique concerns of cloud-based information by implementing stringent industry best practices to ensure the security and integrity of your records.

e-PayDay Pty Ltd is dedicated to mitigating risks through proactive security measures and continuous system monitoring within the e-PayDay FREEPAY® platform. However, effective protection is a shared responsibility. While we provide a secure infrastructure, your active participation in safeguarding your account is a vital part of keeping your payroll data protected.

ATO Operational Security Framework (OSF)

e-PayDay Go fulfils the requirements of the Australian Taxation Office Digital Service Provider (DSP) Operational Security Framework (OSF).

Your Privacy: We Do Not Sell Your Data

We are unwaveringly committed to protecting your privacy. e-PayDay Pty Ltd does not sell your personal information to third parties.

To provide the services within e-PayDay FREEPAY®, your data is only shared when necessary to fulfil legislative obligations—such as reporting to government agencies—or to meet essential commercial requirements, like STP lodgements and Superannuation processing. We ensure all data sharing strictly complies with the Australian Privacy Principles and relevant regulations.

We're proud to share that e-PayDay Go® is an independently audited and certified ISO 27001:2022 secure, cutting-edge Web Application boasting the latest Microsoft Azure, ASP.NET Core, and C# technology stack. For those with a technical inclination, rest assured that our platform has your needs covered now and in the future!

Payroll News and Compliance Insights

Discover how e-PayDay FREEPAY® streamlines complex Australian regulations. From Award updates to legislative changes, we provide the news you need to ensure your payroll remains 100% compliant and free with the help of e-PayDay Pty Ltd.

%201461x1278.jpg/v1/fill/w_320,h_320/file.jpg)